schedule c tax form calculator

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Fannie Mae Cash Flow Analysis.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

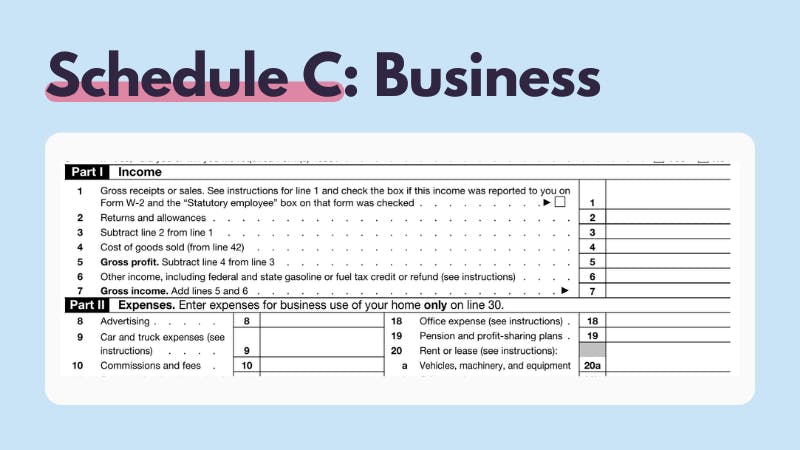

Schedule C Profit Or Loss From Business Definition

Ad Pay 0 to File all Federal Tax Returns Claim the credits you deserve.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 1 online tax filing solution for self-employed. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

381990 x 10 38199. Form 1040 Schedule C. The total cost and the tax implemented on it are calculated by the bonus depreciation calculator.

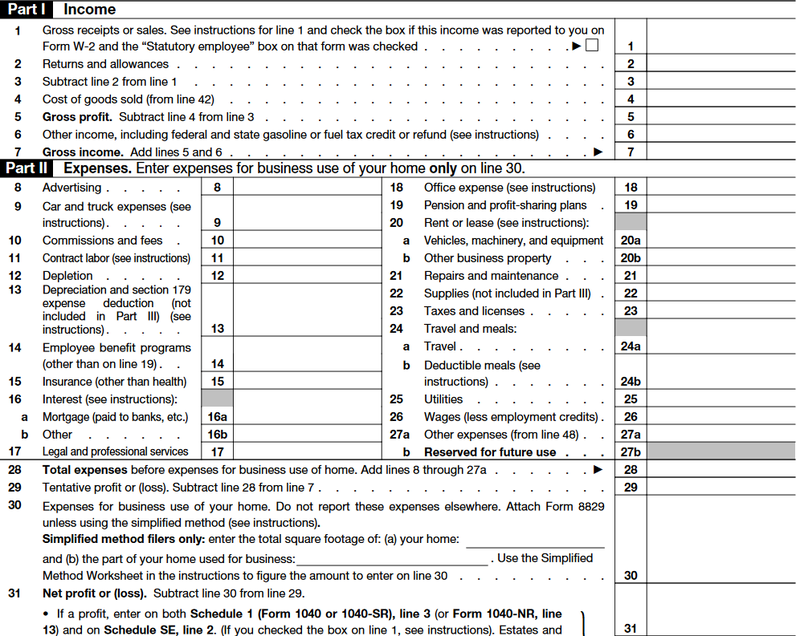

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR. 1040 Federal Income Tax Estimator. Profit or Loss From Business is also integrated into our comprehensive US Tax Calculator where you can.

Go to line 32 31 32. The maximum simplified deduction is 1500 300 square feet x 5. This results in 46175 your net earnings.

Ad Access IRS Tax Forms. In most cases this will be your personal name. Schedule 1 Form 1040 line 3 and on.

Form 1041 line 3. The tax write-offs for being self-employed help save a ton of money when filing income taxes. If you have a tax advisor or accountant download the business tax reports they need to file your taxes Profit Loss Statement Schedule C etc.

Enter your filing status income deductions and credits and estimate your total taxes. IRS Form 1040 Individual Income Tax Return. About Form 1041 US.

Use Tax Form 1040 Schedule C. Income Tax Return for Estates and Trusts. Do not include any farm.

Complete Edit or Print Tax Forms Instantly. If you made the deduction on Schedule C or made and deducted more than your allowed plan contribution for yourself you must amend your Form 1040 tax return and. Profit or Loss From Business.

Adding Schedule C to Your Tax Return. Helping You Avoid Confusion This Tax Season. About Form 4562 Depreciation and Amortization Including Information on Listed Property.

If you have a profit for the yearthat is if your total income is greater than your total expenses by subtracting line 30 from line 29enter the amount on line 31. The resulting profit or loss is typically considered self-employment income. These deductions can be computed using the instructions on your Form 1040 and Schedule SE as guide.

So her depreciation deduction for her home office in 2016 would be. Were going to review this in detail below. Businesses and Self Employed.

Self-Employment Tax Calculator INFORMATION FOR. 45 rows Calculate your tax preparation fee for your personal tax return by using this calculator. Profit or Loss From Business as a stand alone tax form calculator to quickly calculate specific amounts for your 2022 tax return.

Access IRS Tax Forms. Up to 7 cash back Filing a Form 1040 Schedule C could qualify you for an Earned Income Tax Credit or EITC. If you checked 32a enter the loss on both.

If you have a loss check the box that describes your investment in this activity. Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. About Form 1099-MISC Miscellaneous Income.

If a loss you. _____ IRS Form 1040 W-2 Income Officer Compensation Section 53041d1. Income Calculations from IRS Form 1040 IRS Form 1040 Federal Individual Income Tax Return Year.

As a sole proprietor money isnt taxed differently whether in. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. After figuring your total profit or loss on Schedule C transfer the amount to your Form 1040 tax return and Schedule SE Self-Employment Tax.

Self-Employment Taxes for 2021. There are several steps to adding your Schedule C information to your Form 1040 depending on whether you have a profit or a loss. After computing your current years depreciation deductions total them in Part IV of Form 4562 and copy the number to the Schedule C line for depreciation.

Multiply your earnings by 09235 as you only need to pay taxes on 9235 of your self-employed revenue. Information about Schedule C Form 1040 Profit or Loss from Business. When getting a mortgage the qualifying.

Get your expenses organized. About Form 3800 General Business Credit. W-2 Income from self-employment reported on IRS Forms 1040 and 1120 or 1120S Name of business.

Complete the Process. Form 1040 Schedule C. Use tab to go to the next focusable element.

Plan contributions for a self-employed individual are deducted on Form 1040 Schedule 1 on the line for self-employed SEP SIMPLE and qualified plans and not on the Schedule C. Based on your projected tax withholding for the year you can also estimate your tax refund or amount you may owe the IRS next April. By changing any value in the following form fields calculated values are immediately provided for.

Complete Edit or Print Tax Forms Instantly. The Schedule C calculator that simplifies your freelancer tax life All-in-one. If you checked the box on line 1 see the line 31 instructions.

Use tool Estate Tax Liability. Then find 153 of 46174 which comes out to 706462 for the Social Security and Medicare taxes you owe your self-employment tax. Calculator and Quick Reference Guide.

And loss statement has a format similar to IRS Form 1040 Schedule C. Self-Employed defined as a return with a Schedule CC-EZ tax form. Use tool Earned Income Tax Credit Estimator.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. If you file using a software install our plug-in and well tell you the numbers you should enter at every step to prepare your taxes. Part of the Small Business Jobs Act states that you can deduct a percentage of your income for health insurance purposes.

Make tax season a breeze. If you have an LLC youre registered under you can use the business name here. Click on the Print Estimate button when you are finished to print the estimate.

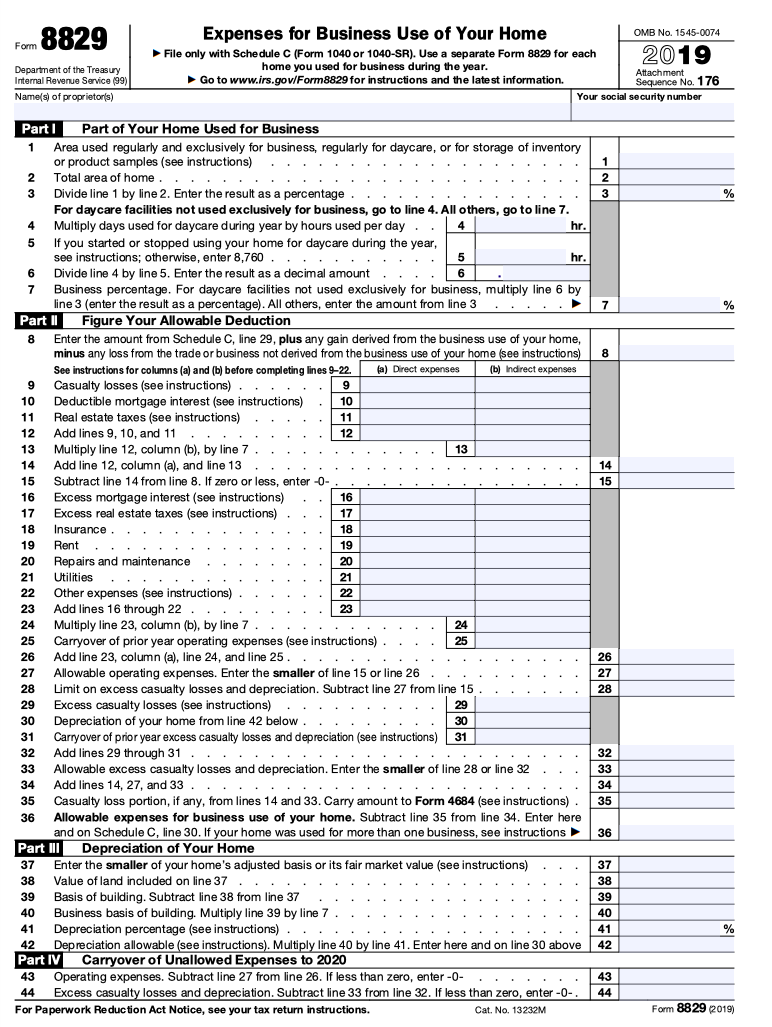

Enter the quantity of forms and check the forms that you need to file and the total amount will be calculated at the bottom. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. You may also need Form 4562 to claim depreciation or Form 8829 to.

Usually if you fill out Schedule C youll also have to fill out Schedule SE Self-Employment Tax. These amounts are reported on IRS Schedule C for sole proprietorships and IRS Schedule K-1 for partnerships. Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000.

If the total of your net. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. Name of proprietor.

Businesses that file Schedule C are pass-through entities meaning they pay tax using their owners Form 1040. The first section of the Schedule C is reserved for your business information. Americas 1 tax preparation provider.

Schedule SE line 2. If you depreciate 359964 and youre in the 22. Please use the calculators report to see detailed calculation results in tabular form.

How to calculate your tax refund. However those write-offs may not be so great when qualifying for a home loan. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business.

For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income deductions and credits.

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

Filing A Schedule C For An Llc H R Block

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Schedule C Form 1040 Irs Taxes Accounting And Finance Schedule

Irs Crypto Tax Forms 1040 8949 Koinly

A Complete Guide To Filing Taxes As A Photographer

What Do The Expense Entries On The Schedule C Mean Support

Sole Proprietor Tax Forms Everything You Ll Need In 2022

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Free 9 Sample Schedule C Forms In Pdf Ms Word

Schedule C Instructions With Faqs

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

How To Fill Out Your 2021 Schedule C With Example

Schedule C Income Mortgagemark Com

How To Fill Out Form 8829 Bench Accounting

Free 9 Sample Schedule C Forms In Pdf Ms Word

How To Fill Out Your 2021 Schedule C With Example

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)